The fairy tales we cherished as children often painted a vivid picture, complete with a magical realm where wishes were granted. Among the mystical beings, the Tooth Fairy stood out, rewarding us for our first rites of passage into the realm of toothless smiles. Yet, as adulthood dawns, our vision concerning our oral health transitions from a charming fairy tale to a budgeting challenge that demands our utmost planning and care.

In this blog post catered to oral health enthusiasts, we’ll explore strategies for making this vital part of your well-being an affordable and manageable aspect of your life.

The Importance of Long-Term Dental Health

Dental health goes beyond just the bi-annual check-ups — it’s a lifelong commitment. Neglecting our teeth can spiral into issues that not only affect our smile but also our overall health. Poor oral health has been linked to heart disease, diabetes, and other significant health concerns.

In a dynamic and fluid health system, we understand that the price of proactive dental health pales in comparison to the cost of neglect. Just as you would save up for a rainy day, the same reasoning applies to your dental care.

Understanding the True Cost of Dental Care

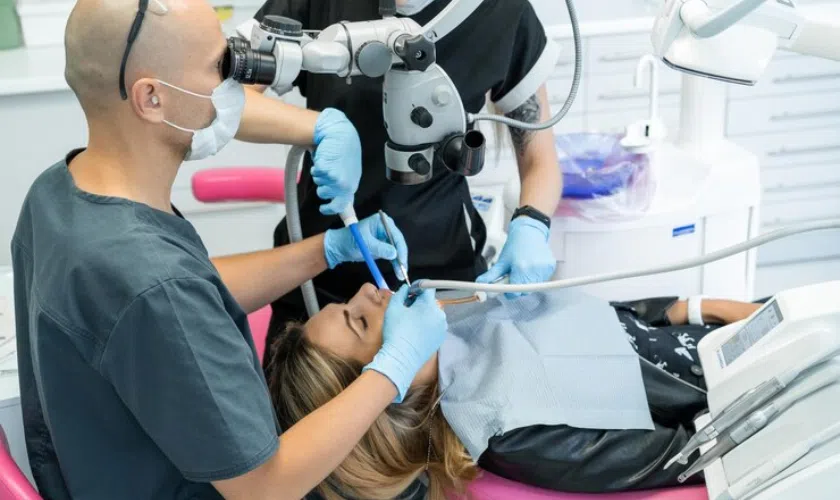

The first step to budgeting for your dental health is to comprehend the real cost of treatments and care. From routine cleanings and fillings to more complex procedures like root canals and orthodontic work, each requires a significant investment.

Finding affordable dental implants in Shelby Township is a routine task, yet the out-of-pocket expenses may surprise you. Before setting your budget, it’s essential to research the average cost of treatments locally, exploring options across different dental practices.

Strategies for Budgeting Your Dental Health Journey

The heart of effective dental health budgeting lies in developing a comprehensive plan:

- Create a Separate Budget Line: Just as you allocate funds for groceries or entertainment, set aside a specific amount for dental care. Treating it as a necessary expense helps you avoid the temptation to dip into these funds for other purposes.

- Prioritize Dental Costs: It’s crucial to demarcate between cosmetic and essential dental procedures. Prioritize those that maintain or restore function over purely aesthetic procedures.

- Plan for the Unexpected: Emergencies happen, and your teeth are not immune. Add a cushion to your dental health budget to account for unforeseen events that might require immediate attention.

The Role of Insurance and Savings Plans

If considering dental care as part of your regular health budget seems overwhelming, insurance and savings plans provide the necessary support structures.

- Dental Insurance: Invest in a robust dental insurance plan that offers coverage for a wide range of treatments. Familiarize yourself with your policy’s details, noting coverage limits and exclusions.

- Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA): These accounts allow you to set aside pre-tax income for eligible medical expenses, including dental care. Take advantage of these savings plans to reduce your financial burden.

Practical Tips for Reducing Dental Costs

In your quest for affordable dental care, several practical steps can significantly lower your overall spending.

- Regular Cleanings & Check-ups: Prevention is better than cure. Regular visits not only help in early detection but also preserve your oral health against costly treatments down the line.

- Seek Affordable Alternatives: In instances where you need dental work, discuss with your dentist about cost-effective options, including generic medications and less invasive treatments.

- Look for Discounts and Packages: Some dental practices offer discounts on cash payments or bundled packages for common procedures.

Long-Term Investment in Preventive Care vs. Reactive Treatments

Preventive care is akin to financial investments that yield compounded returns over time. Investing in maintaining your dental health today guards against future costly treatments.

- The Power of At-Home Care: Daily brushing and flossing, combined with a healthy diet, form the front line of preventive dental care. Appropriate self-care can reduce your need for professional intervention.

- Fluoride and Sealants: Additional protective measures such as fluoride treatments and dental sealants can fortify your teeth against decay, often at a fraction of the cost of repair work.

Conclusion

In our quest for financial prosperity and a robust health outlook, including your dental health in your budgeting plans is indispensable. It’s a commitment to your well-being that requires thoughtful consideration and preparation. Whether through proactive care, insurance, or strategic savings, the investment in your dental health today secures a happier and healthier tomorrow.

The path to affordable dental health may not be as magical as the folklore surrounding the Tooth Fairy, but with a sensible approach, it is certainly achievable. By initiating these budgeting strategies and maintaining an open line of communication with your dental professionals, you’re not just smiling through life; you’re smartly planning for it.